Short Update - Market Analysis for Jan 15th, 2026

I am putting out a short update since I am absolutely exhausted from my travel to Israel today.

In gold, we now have enough waves to consider this rally as having topped. Yet, we have not seen the usual hallmark of an ending diagonal completion, wherein it spikes through the trend channel followed by a stronger reversal back into it to start its decline. So, until we actually see a sustained break down below 4545, I still have to leave that door open.

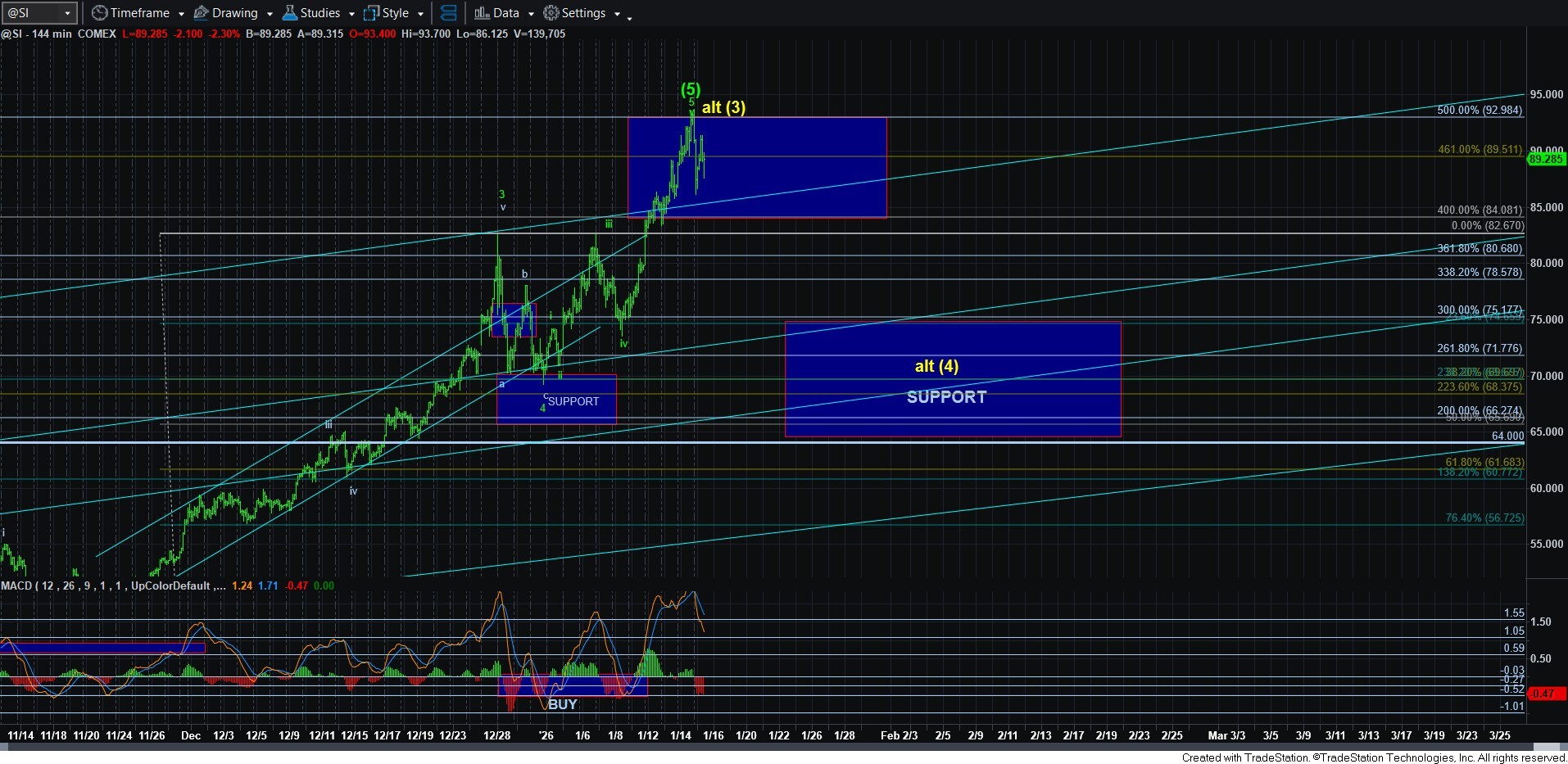

Silver has more than enough waves in place as well. But, due to how high we have come in this segment of the rally, I am also leaving the door open to the iv-v shown on the 8-minute silver chart.

And, of course, we can say the same of GDX. And, a break down below 88 places us squarely in wave 4.

The main point here is that this market is VERY extended, and it is reasonable to expect a larger degree correction will begin quite soon, as I have outlined in the recent updates.